Here's How a New Medigap Plan Can Save Texans Thousands

Last Updated: Feb 1, 2024

Seniors are averaging than $5,700 per year on out of pocket medical expenses – but Medigap aims to help change that.

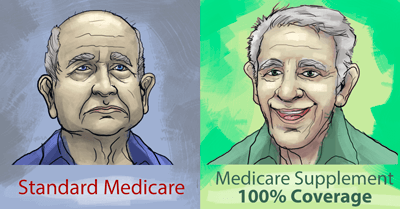

Are you aware that your deductibles and co-pays could be covered by Medicare with a Medigap plan? These plans help cover the 20% gap expense leftover from Medicare coverage.

Without Medigap, seniors may be responsible for paying 20% of each covered Medicare claim, and with Medigap this leftover cost is covered. This means less worry each time a medical expense is paid. Thanks to Quick Medigap, you can start the process online and then review matching Medicare supplement plans.

What exactly do you need to do? Here is one easy rule to follow.

You have to compare carriers. Don’t even consider enrolling in a Medicare Supplement plan without doing this first. In our review of Medicare subscribers, we just couldn’t believe how many people were paying for a Medicare Supplement where there was a better or lower priced plan available. With Quick Medigap, comparing plans is a breeze. Their network of top insurance companies and agents help seniors save more money on their medical expenses.

Seniors in don’t always realize that they may be able to save on a big portion their medical expenses by enrolling in a good Medicare Supplement plan. This is because the information isn't always easy to find, and also because many seniors are presented with so many different plans. Fortunately, a lot of smart seniors out there figured out how to enroll in the right plan using Quick Medigap free service to find the perfect plan.

It’s really no wonder that with so many seniors saving money on their medical expenses, Quick Medigap is gaining momentum. Quick Medigap is an efficient source that tries to give consumers access to the Medicare Supplement plans that have the desired coverage at the lowest prices.

See If You Are Eligible:

- Step 1: Simply tap your age below and enter your zip code on the next page.

- Step 2: Answer some basic health information and then review all of your available Medicare Supplement plans and coverages

Select your age: